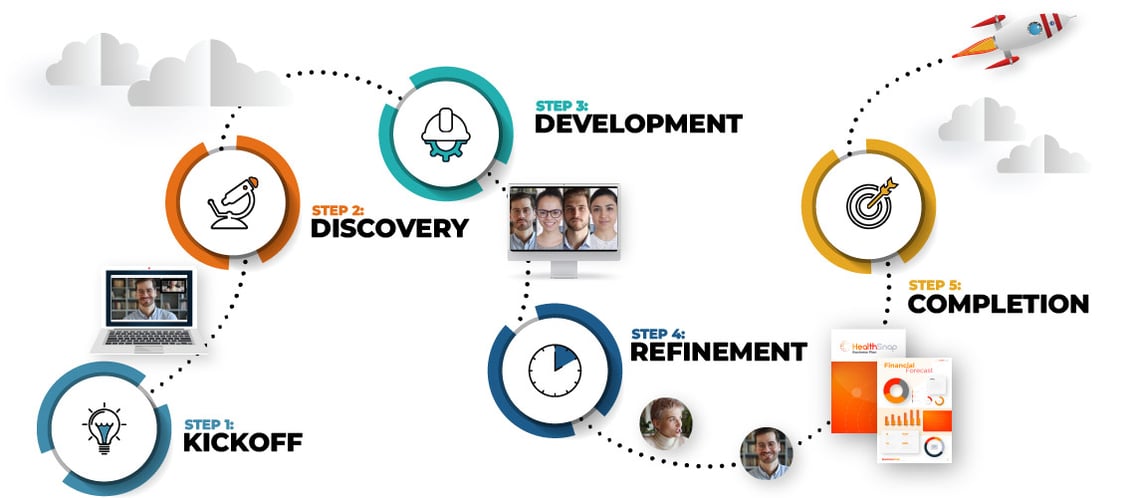

3.5 Weeks

Average Project Timeline

Talk to an Expert

Are you ready to take the next step in your entrepreneurial journey? Schedule a 30-minute meeting with one of our professionals so that we can better understand your objectives, advise you on appropriate steps or provide a full proposal.

It’s no easy feat to write a business plan that meets lender and Small Business Administration standards for 7(a) or CDC/504 loan programs. Click the button below and we will email you three full example PDFs of our bank- and SBA-targeted work.

Fill out the form below and we'll email you examples of the business plans we create.

A professional business plan helps investors to understand and believe in your business. Click the button below and we will email you three full example PDFs that will demonstrate proper structure, analysis, and narrative to capture and retain investor attention.

Fill out the form below and we'll email you examples of the business plans we create.

It's not easy to put together a business plan that hits all of your targets. With that in mind, our team created this comprehensive business plan Q&A to help you along the way. But if you get stuck or need help, don't be afraid to call on our experts.

Contact Us

Schedule a 30-minute meeting so we can better understand your business, advise you on next steps, or develop a scope-of-work.

Average Project Timeline

The Only Inc. 500 Planning Company

Average Workday Response Time

Schedule a 30-minute meeting with one of our business planning experts so that we can better understand your objectives, advise you on appropriate steps or provide a business plan development proposal.

Oct 5, 2023 by Ben Worsley

Entrepreneurs are often celebrated for their uncanny ability to understand others – their customers, the market, and...

Aug 30, 2023 by Ben Worsley

Despite growth in sectors like artificial intelligence, venture capital funding has seen better days. After peaking at...

Aug 22, 2023 by Masterplans Staff

Most people think of a professional business plan company primarily as a "business plan writer." However, here at...