How to Write a Management Summary for Your Business Plan

Entrepreneurs are often celebrated for their uncanny ability to understand others – their customers, the market, and the ever-evolving global...

One of my favorite aspects of financial modeling is that it is a logic puzzle. You take one piece of data and figure out how it is related to other pieces of data before stitching them together to form a picture.

Today, I'd like to show you how you can use free data from the SBA to estimate how much money you may need to start a business, as well as how much revenue you might need to be successful!

Perhaps you are at the very beginning of your business planning journey and want an initial estimate of the size of the loan you might need. You wonder if you can afford a 10-20% required owner contribution.

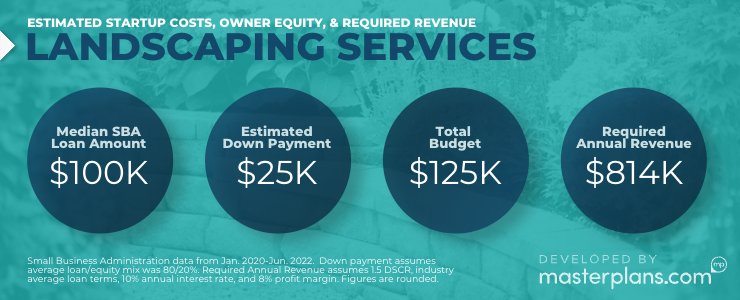

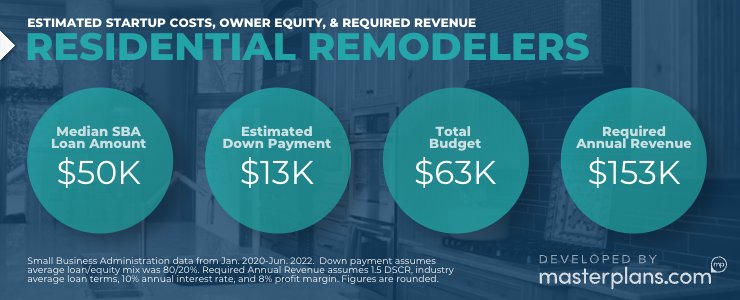

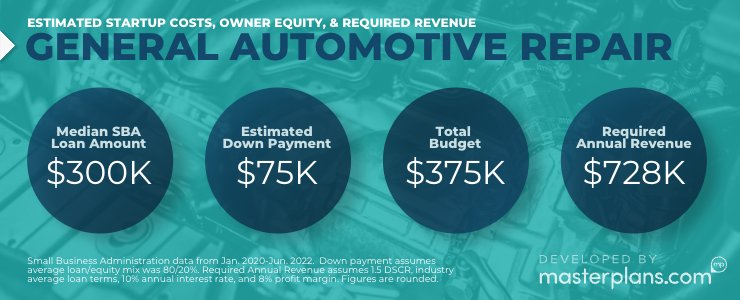

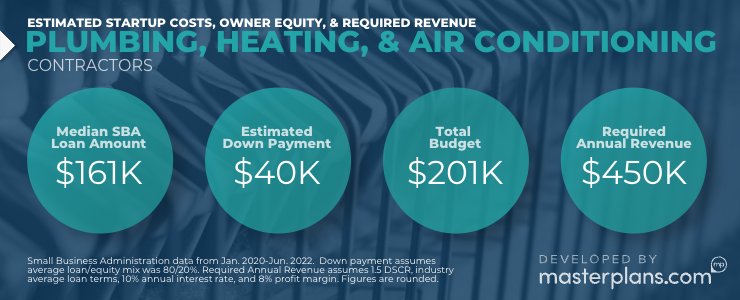

The SBA publishes historical loan approval data which includes industry, loan amount, loan term, and lender. If you assume that these loan amounts were 80% of the total cost to start or expand a business, you can back into an estimated total budget. For example, If a loan was $100K and that represented 80% of the cost (a safe bet), the total cost is $100K divided by 80% or $125K.

Using the same logic, if the owner contribution was the remaining 20%, a related down payment would be $25K. Based on a review of your industry’s loan data and by using this math, can you afford an average down payment? We’ve made this easy for you later on in this post by highlighting our estimates for ten of the most common SBA 7(a) loan industries. You can also check out our much more extensive calculator that lets you tinker with several inputs for other business types.

Not seeing your target industry?want to play around with inputs like loan size and interest rate?Try our Startup Business Loan Calculator! |

Once you are able to estimate your total project size and down payment, you can roughly estimate your business’s required revenue for its first full operating year. Let’s go back to the earlier example of a $100K loan with $25K owner equity and assume it applies to your dream business. If the $100K loan had a 10 year term and 10% annual interest, you can input those numbers into an online amortization calculator to arrive at a monthly loan payment of $1,322. On an annual basis, your loan will cost you $15,864 per year. It’s likely that an SBA lender will want to see that your forecasted earnings will be able to cover this cost by at least a factor of 1.2. To be conservative, you should safely estimate a multiple of 1.5 or in industry terms, a 1.5 debt service coverage ratio (DSCR).

Required Annual Earnings: 1.5 DSCR x $15,864 = $23,796

You may know that a start-up company like your dream business can earn a profit margin of 8% of revenue, so armed with that information, you can back into required annual revenue to cover your debt service.

If you divide $23,796 in profits by 8% you arrive at $297,450. Do you think your business will earn this much revenue in its first year? If so, it may be time to start that business plan!

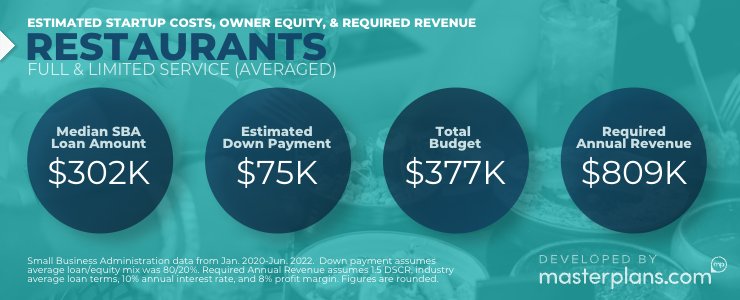

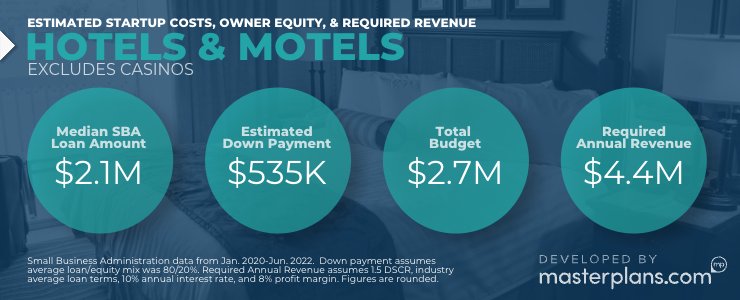

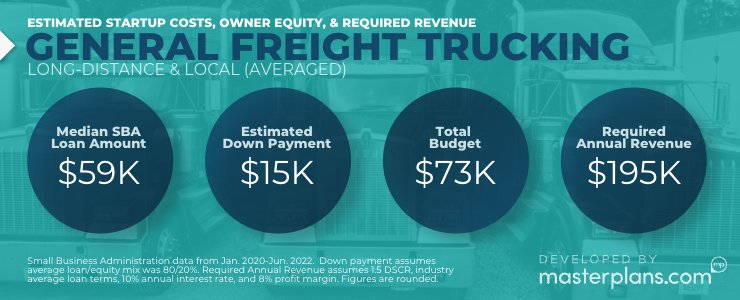

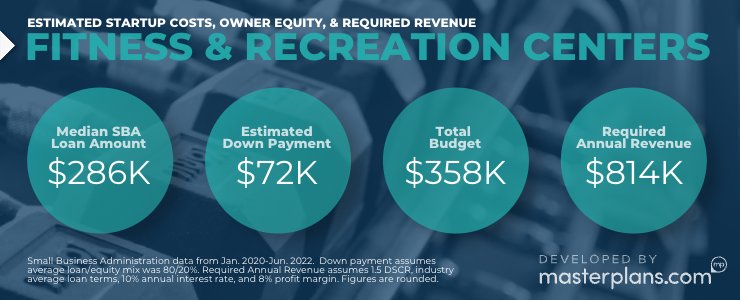

To estimate industry-average start-up costs for ten common businesses, owner down payments, and required revenue, we’ve analyzed SBA loan approval data from January of 2020 to June of 2022 and made some estimates.

Our methodology for calculating startup cost, down payment, and required revenue:

|

The results of our industry analysis follows along with a hypothetical discussion of the amount of the transaction volume you might need to present an attractive financial model to meet bank requirements.

Based on SBA 7(a) loan averages, an owner’s investment in their restaurant could require a $75K down payment. If hypothetically, this restaurant required $809K in annual revenue, and the average ticket (meal) was $25, the restaurant would need to sell 108 tickets per day over 300 operating days per year. If it were open 12 hours per day, it would need to sell about 9 meals per hour. While these estimates/averages could differ meaningfully from the start-up cost and planned price point of your restaurant, it’s great to start thinking along these lines. If you add up your restaurant’s expected start-up cost, can you pay 10-20% of these costs as your owner's contribution? How many meals would you need to sell to pay your debt back by a factor of 1.5 times if you had an 8% profit margin?

Let’s suppose that a hotel required $2.675 million to complete and had 35 rooms at a development cost of about $76K/room. If the hotel were open 365 days per year, and the average nightly rate was $400, it would require an occupancy rate of about 87% to reach the required amount of revenue with an implied 8% profit margin.If that nightly rate were too high in comparison to the local competition, this hotel owner might need to find some creative ways to increase revenue (getting commissions for sales of services or tour packages, or offering room add-ons or amenities) or lower expenses if they were going to make this business work. It’s these types of considerations that a well researched financial model will help you determine.

Based on average loan information, we estimate that it may cost about $73K to start a trucking company. We suspect this also entails leasing trucking and trailer equipment. Based on averages, a 20% down payment for this business could require over $14.6K in funds from a potential trucking business owner. If they managed an 8% average profit margin, and drove 245 days per year at a mileage rate of $3/mile, they would need to drive 5,423 miles per month to generate enough income to repay their debt and have an attractive operating cushion. Is your dream to escape office life and hit the open road? Can you afford the owner equity requirement? If so, by putting the finishing touches on your trucking business plan with well thought out trucking financials, you can make your dream a reality.

Maybe you were a high school sports team captain that became a personal trainer with a dream to someday open your own gym. Based on average loan amounts, your own gym, with new machines and weight stations, could cost over $350K to start. If your SBA loan requires a 20% owner equity contribution, you’d need to put down $71,500 of your own money. If your gym was able to reach a profit margin of 8% and you charged $100/month per membership, you’d need 679 memberships to make it work. Does that seem like too many for the size of your gym? Could you increase the membership monthly rate, offer some private personal training sessions, or sell smoothies and merchandise to lower memberships required? When you are building your financial model for your gym, you’ll need to see what you can tweak to reach required revenue but also make sure you’re being realistic. What is the competition charging? What are people spending on fitness in general in your market area? Is your market saturated or is their opportunity? Some good business plan market research for your gym can be very illuminating.

Are your thumbs greener than most and your lawn the most manicured on your block? Do you have a bunch of neighbors who have committed to hire you if you were to start your own landscaping business? According to SBA 7(a) loan averages, you may need a $100K loan, which could require a $25K down payment. If you planned on charging customers $150/month for lawn maintenance, you would need 165 monthly clients, if you had an 8% profit margin. Is that doable?

Of all the industries in this list, residential remodelers have the lowest average loan amount and required down payment based on averages. Besides relevant experience, maybe you’d just need a truck, licensing, a marketing budget, and some tools to launch your own remodeling business. Do you think you could secure three $50K jobs per year to hit the required revenue that a hypothetical 8% profit margin implies? If that seems achievable and you can afford a $12,500 down payment, you could be your own boss soon!

A general automotive repair business might require $375K to start. You’ll likely need to buy diagnostic equipment, lifts, and possibly renovate an existing garage, which could require $300K from the bank and $75K from you. With an 8% profit margin, you might need to perform $728K in automotive repairs per year. If you were open 49 weeks per year and 6 days per week and your average service cost $350, you might need to have 3-4 cars on each of your two bays every day. Has your research determined that your market has enough of a driving population that is not being served by existing businesses to keep you that busy?

Do you think you can do a better job than your current employer in servicing clients and want to start your own plumbing, heating, and/or air-conditioning contracting business? It might take a $161K loan and about $40K of your own money. If you were open 245 days per year and your average job was $1K, do you think you could average just over 1.8 jobs per day to attractively cover your debt service? Maybe this is especially doable if your current employer is turning away this much business since they are so busy and are unable to hire enough quality trades people like you.

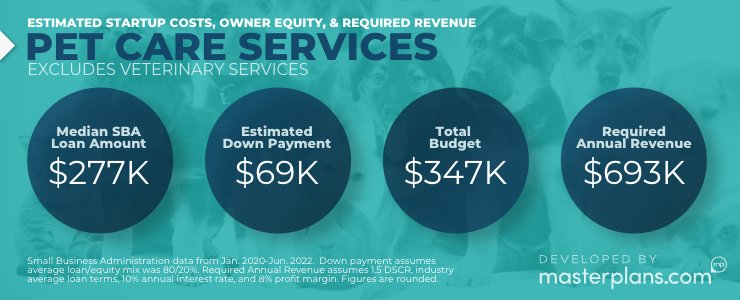

This average loan amount of $277K likely includes very different types of businesses like doggy day cares or overnight boarding, cat cafes, or pet groomers, which could have much different start-up costs. In any case, based on the industry averages, for a loan this size, you might need to put down a $69K down payment to start up your dream pet care business. If you were able to achieve an 8% profit margin, and you charged $50/day for dog boarding, your 50-dog capacity kennel would need to be 76% occupied. Are there lots of jet-setting dog owners in your neighborhood and not enough kennel space at facilities that keep dogs stimulated and happy? If so, the timing may be right for you to launch your very own pet care business.

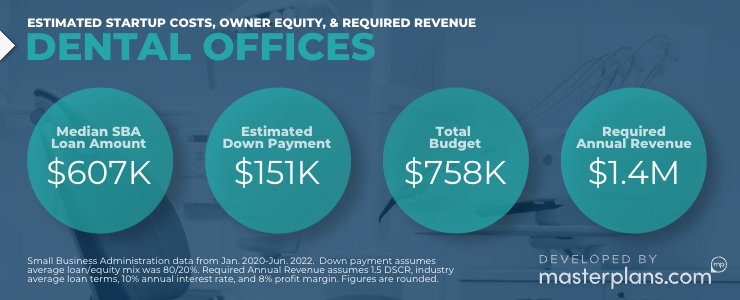

You may have been at a dental group for a while and now the owner is retiring and selling the building. If you can swing a possible $151K down payment, it could be the perfect time to strike out on your own, inherit their clients, and even hire a second dentist. If you both work 245 days per year and see over 10 patients per day each at an average visit of $300/patient, you could achieve the required revenue of $1.4 million per year at an 8% profit margin – based on the average loan size of $606K.

Entrepreneurs are often celebrated for their uncanny ability to understand others – their customers, the market, and the ever-evolving global...

Despite growth in sectors like artificial intelligence, venture capital funding has seen better days. After peaking at $347.5 billion in 2021, there...

Most people think of a professional business plan company primarily as a "business plan writer." However, here at Masterplans, we choose to approach...