How to Write a Management Summary for Your Business Plan

Entrepreneurs are often celebrated for their uncanny ability to understand others – their customers, the market, and the ever-evolving global...

This is the first in a series of posts that will elaborate on the specific answer to the question: What do investors look for in a business plan?

If you've tried to raise money or researched the business plan presentation for potential investors, you already see that there's a wide range of opinions and demands. In the end, investors are just as diverse and dynamic as the enterprises and entrepreneurs they invest in.

For example, some invest their own money (Angels) while others manage a fund (Venture Capitalists). Some invest in series pre-seed (commonly referred to as the idea stage) or series seed (commonly referred to as the MVP or prototype stage), and some invest in later stages such as series A or series B.

But there's one thing all investors have in common: the desire to grow their money. As simple as it may sound, one of the most common mistakes novice entrepreneurs make is failing to address how the investor will see a return on their investment (ROI).

However, before you begin to discuss the investor's return, you need to develop context and create a persuasive argument for your business, which you do by properly addressing these five essential topics in your business plan:

To be clear, this is not a series devoted to your pitch deck, style or format, or pitching skills; these might vary as much as the investors you intend to target. This series is about analyzing the content of your business plan or investor materials and, if you are not well prepared, what to do about it.

In most cases, investors wish to comprehend the problems you're addressing or the trend you're capitalizing on. It can be helpful for you to hear from prospective customers about their problems. You can also learn about problems by surveying customers of competitors in your field or by reading social media posts or technical forum threads that highlight their frustrations. These types of direct reports from customers are known as stated problems.

However, stated problems are usually only a small piece of the picture and, in my experience, do not contribute significantly to innovation. To elaborate on this, my favorite quote that hits the nail on the head dates back to the invention of the Model T by the grandfather of manufacturing:

“If I had asked people what they wanted, they would have said faster horses.” - Henry Ford

Henry Ford understood a concept known as implied problems. The implied problems of his day? Horses are slow, require excessive maintenance (stables, hay, oats, grooming, etc.), and defecate in the streets. He recognized instinctively that there was a better way.

As an entrepreneur, you must also recognize implied problems the same way Henry Ford did, and concisely and effectively explain your logic and rationale about your target customers’ implied problems in such a way that the investor has an aha moment.

Due to the nature of trends, they are considerably easier to recognize. Generally, there is a social awareness and associated empirical data (research) that something is happening in a market or environment. The shift toward remote work is a prime example of a recent trend, and many businesses have positioned themselves to capitalize. In contrast, numerous businesses have been negatively affected by this trend.

Pro Tip: you may or may not have picked up on the fact that trends can, and often do, create problems, either stated or implied. Lean into this. Also, if you find the trends section of your brainstorming wall looking like that of a true crime detective, it’s probably not a trend. Trends should be easily explained, the investor should say, “yeah, I’ve heard about that.”

Now, novices frequently confuse opportunity with market size, so let's clear that up first. Opportunities are not always synonymous with market size; in fact, some opportunities generate previously unknown new markets. And understanding opportunities will help you position your product and brand, so it's pretty darn important.

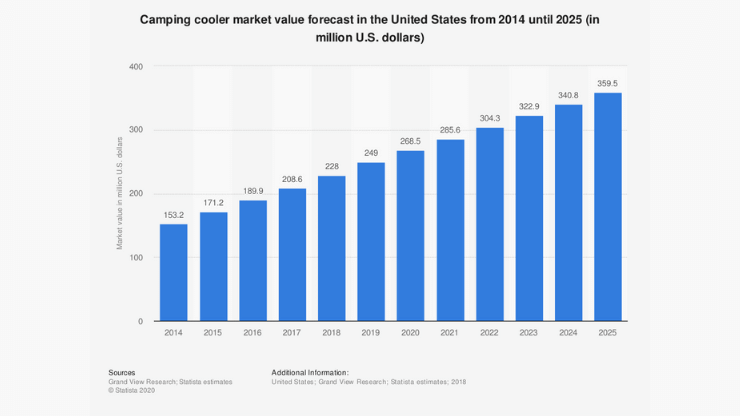

Suppose, for instance, you’re developing your business plan for angel investors and you have invented a novel, patented insert for coolers that keeps sandwiches and beverages organized and out of the water that collects at the bottom. And your product is well designed, well built, and expensive. You could spend thousands of dollars on gated (paid) research, which is crucial but only relays part of the facts. Why? Because market data tends to favor combined totals, which is significant, don't get me wrong, however, it only provides a partial picture of the opportunity. Accordingly, in the example of our cooler insert, it is essential that we understand the size and trends of the camping cooler market in the U.S.:

This information from Statista is valuable knowledge, showing that the market is substantial and continually expanding. However, it does not assist you in creating a strong narrative for your particular opportunity. Instead, utilize one or more opportunity lenses to allow you to get more specific. For example, you may use the complementary product opportunity lens which would have you focus your research on growth within a certain segment of the industry that corresponds with your product's intended customers (e.g., premium cooler customers). And information about the market leader in this segment may prove more compelling.

Since 2015, the compound annual growth rate for YETI, the global leader in premium brand coolers, has been greater than 18%. In fact, YETI's cooler and equipment sales totaled $552 million in 2021.

This type of information will help indicate that you have a strategic, targeted approach to the opportunity and that you are tying data from a complementary premium category to your premium offering (i.e., cheap coolers are also lumped in with the broad market data and irrelevant to your product). This type of opportunity analysis frequently influences design decisions, market entry point, and marketing techniques. Wouldn't it be great if you reached an agreement with REI and Cabela's to place your cooler insert display next to the YETI display?

I cannot overstate the importance of focusing on the strategy outlined in your business plan or investor materials with one or more opportunity analysis lenses. Here is a list of the most common opportunity analysis lenses:

You may be wondering, aren’t opportunities the ‘O’ in a SWOT analysis and why aren’t you talking about that? Well, two reasons. First, this post is focused on startups and early-stage companies and they tend to be a little light on strengths, their weaknesses are, well … everything, and the same with threats. Second, remember how I started this post? You’re trying to convince investors, usually in about 5 to 20 minutes, that your business is worth investing in, and that it has the potential to create a return. They aren’t going to cut a check right away and you're focusing on getting a second meeting. Trust me, as you begin to forge a relationship with an investor (if they are any good) there will be plenty of time to get into the threats you both see on the horizon and what to do about them. So, for now, spend your energy, time, and resources on using the lenses to analyze potential opportunities. I’ll get into more detail on each specific lens and how they are utilized in a separate post, which I’ll link back to here.

One of the most frequent questions investors ask our clients is, "Why is now the ideal moment to launch this product/company/brand?" This question can throw off an inexperienced or ill-prepared entrepreneur. After all, you don’t have a crystal ball. Or do you?

Trick question. You don’t. No one does.

In lieu of a crystal ball, though, you have facts and logic, which are much more powerful. Timing is all about capitalizing on the knowledge gained via research and analysis (see above). Typically, it is not rocket science, and if it is, you had best ensure that your investors are also rocket scientists (hint: investors are not rocket scientists). I recommend that you attempt to anticipate this issue and provide a response in your materials. What trends are you noticing or market events have transpired to indicate now is the optimum moment to enter your market? And be honest with yourself; if you're opening a specialty grocer in a growing suburb, has the population reached its optimal level, or are you too early? If you're too early, are you ready to burn cash by operating in the red to prevent a future competitor from entering the local market? If you're an app developer and you detect a certain trend that your competition hasn't addressed, is it the proper moment to deliver your solution to the customer? In general, your market timing assertion is a logical inference. However, you need also to be familiar with two distinct concepts: the first mover and fast follower.

Do you know if Google was a first mover or a fast follower? And don’t cheat by Googling it (whoa, this just got meta).

I’ll get into the concept of first-move and fast-follower in another post and how investors tend to consider you when claiming to be either.

Why do I wait until now to discuss how fantastic my solution is? Don't investors want to know that my product satisfies every requirement and desire of customers?

In all but a few instances, I highly encourage you to wait. Unless, of course, you’ve solved nuclear fusion and the world's dirty energy problems, or you have built a safe and cost-effective teleportation system. Essentially, if you've invented something that has been in the Sci-Fi zeitgeist for decades, if you merely demonstrate the solution, investors will be clamoring to invest in your company. However, for the rest of us, we must first grasp the problems, trends, and opportunities for ourselves and our company, and then be able to contextualize the situation for the investor. Without this context, the investor cannot even begin to determine if there is any meat on the bones of your solution.

Lastly, your proposed solution does not depict your product, its features, or its benefits. Your proposed solution is the solution itself. Customer X has problem Y, for which our solution is Z. That's it. Going back to Henry Ford, he might have said something like this: Our target customer is any red-blooded American who travels more than three miles per day on horseback, is sick and tired of boarding fees, a sore butt, and feces-covered streets, and we will deliver him an inexpensive, fast, and reliable motorized carriage which will solve all these problems and more. Notice, Mr. Ford did not say anything about the Model T or its features (e.g. how many people it would carry, or how far it could go on a tank of gas).

Pro Tip: One thing to keep in mind is that you likely began creating your prototype, sketching the schematics for your new retail concept, or developing the UX/UI of your app by anticipating and predicting the market's needs. I call this the entrepreneur’s intuition. I love working with entrepreneurs because they have the unique ability to predict when something will be in vogue or needed. However, when you do these exercises, make sure you are not merely searching for evidence to support your argument (confirmation bias). If you only look for information to confirm your assumptions, you will likely miss the chance to evolve or redesign your product or model based on those findings, thereby making your business plan even stronger; or you will be unprepared to defend your position when, inevitably, the investor asks the dreaded "but what about ________________?" You should search for evidence to both support and refute your assertion. Only then can well-informed reactions, positioning statements, and plans be formulated.

Again, resist the urge to dive into the product itself and all of its innovative features at this stage. Customers purchase products based on two questions: 1) Does this product solve my problem/pain (or do the job I hired it for)? and 2) What are the benefits I will receive by purchasing this product? Logic suggests that if this is how customers think, investors will want to know this because it will further convince them that their money is safe with your company.

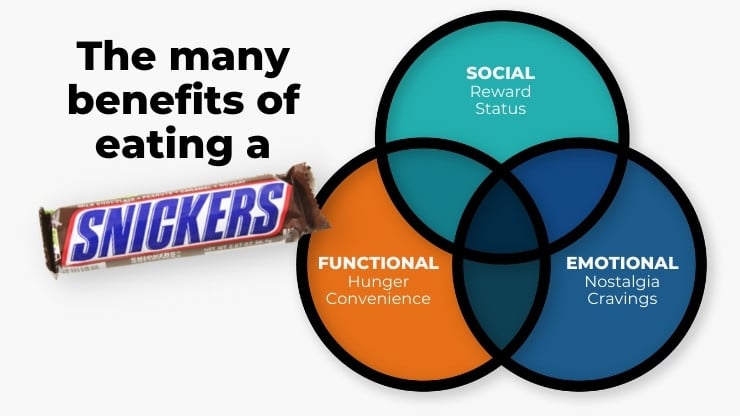

Benefits are, if you will, an additional lens that assesses and explains how your product will touch the lives of your customers. There are six benefit categories:

It would be nice if customers were these tidy, little creatures, responding to a single benefit. However, most people, consciously or unconsciously, seek multiple types of benefits from the product they purchase. Kind of a two (or three) birds, one stone approach. Can you guess which types of benefits your favorite brands are communicating? I’ll give you a hint - even simple products, like candy bars, focus on more than one benefit. I will devote another post to defining and explaining each.

Unless you've been meticulous in your business planning or investor materials development, you're probably feeling quite overwhelmed at this stage. I acknowledge that these are challenging topics and that there is no one-size-fits-all solution. If it were simple, everyone would do it. However, I am convinced that one of two outcomes will occur if you abandon confirmation bias, roll up your sleeves, and utilize this method to develop your model, strategy, and materials. Either you'll conclude that the idea you're working on is not as innovative and investor-worthy as you originally believed (which is good, as it saves you money, time, heartache, a bruised ego, and relationships, and allows you to move on to your next idea), or you'll be better equipped to help your investors realize that you’re a good bet, thereby facilitating the launch, growth, and success of your company.

Entrepreneurs are often celebrated for their uncanny ability to understand others – their customers, the market, and the ever-evolving global...

Despite growth in sectors like artificial intelligence, venture capital funding has seen better days. After peaking at $347.5 billion in 2021, there...

Most people think of a professional business plan company primarily as a "business plan writer." However, here at Masterplans, we choose to approach...